The Homebuying Process

Buying a home is a big commitment. It’s also one of the most exciting purchases you’ll ever make!

Step 1: Create Your LiveBaltimore.com Account

Once you’ve created your account, use interactive tools to find your perfect neighborhood and match with financial incentives. Save neighborhoods, financial incentives, and real estate partners to your Personalized Moving Planner for reference as you move through additional steps in the homebuying process.

Step 2: Sign-up for Homeownership Counseling and Earn Your Counseling Certificate

Nearly all homebuying incentive programs require that you earn a Homeownership Counseling Certificate from a City-approved counseling agency BEFORE making an offer on a home. Certificates are good for one year. We recommend obtaining your certificate early in the process, so you aren’t delayed when you find your dream home! Counseling typically takes less than 10 hours of your time, starting with an eight-hour class and followed by a one- to two-hour one-on-one session. Some counseling agencies also offer self-paced, online classes and expedited one-on-one appointments.

Step 3: Choose a Mortgage Lender and Get Pre-Qualified

Working with a lender who is well-versed in the City’s financial incentive programs is critical to buying in Baltimore! Contact a knowledgeable mortgage lender for pre-qualification and guidance on using incentives to buy your home. By getting pre-qualified by a mortgage lender early in the process, you can focus your home search on options you can afford.

Step 4: Choose a Real Estate Agent

Now for the fun part: house hunting! You want an agent who can give you a local’s perspective and who knows the particulars of homebuying incentives, property taxes, tax credits, ground rent, and other aspects of homebuying in Baltimore City. Start your search for a real estate agent in our directory of City Living Experts, who have each completed an accredited course on Baltimore City’s housing market through the Greater Baltimore Board of Realtors.

Step 5: Choose a Home Inspector

Once you’ve found your dream home, ensure it checks out. Your home inspector will look for maintenance issues and property defects that may not be visible to the untrained eye. Some loans and incentive programs require more rigorous “Housing Quality Standards” or HQS inspections. Consult your real estate agent and lender to determine which type of inspection you require. When hiring a home inspector, check their certifications against your needs.

Step 6: Choose a Homeowners Insurance Agency

Homeowners insurance must be secured before you close on your home. You typically must pay for one year of homeowners insurance (sometimes called hazard insurance) up front, in addition to other fees due at settlement. As with all real estate partners, choose an insurance agent with whom you feel comfortable.

Step 7: Choose a Title Company

As your final loan is being approved, secure a title company to work with. A title company will review your new home’s ownership records to make sure there are no liens or outstanding legal issues surrounding the home. You have the right to choose a title company with whom you want to do business. Your lender or agent may recommend a title company. We also suggest choosing a title company that is based in the Baltimore City and well-versed in city transactions.

Step 8: Get Your Keys and Move In

After you sign the appropriate documents, you will be handed the keys to your new home. You are now a homeowner! Pack up your belongings and move in with the help of a trusted mover. Settlement paperwork should always be stored in a safe place. Don’t let it get lost during your move!

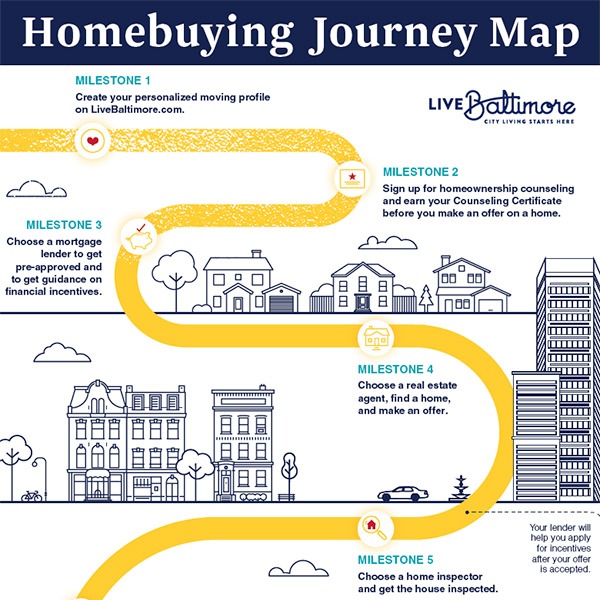

Do you need a digital, printable, or visual version of the homebuying process listed above?

Do you need a digital, printable, or visual version of the homebuying process listed above?

Live Baltimore created this guide designed to make the process of purchasing a home in Baltimore easier for you. In the guide, you will find a list of major milestones and important partners to seek out along the way.

You will also find a map to help you keep track of where you are, where you’ve been, and where you want to go in the process.

To get started, download the guide here or click on the graphic to the left.

Have more questions about the homebuying process?

We’re here to help. Send us an email or call 410-637-3750 for one-on-one assistance.

Take the First Step

- Save your recommendations for later.

- Get access to our Financial Incentives Tool.

- Connect with a Live Baltimore staff member for a one-on-one consultation.

- Get a free I ♥ City Life bumper sticker.