Photo by J.J. McQueen for the Mayor of Baltimore City

Buy Back the Block

The Buy Back the Block program provides grants to Baltimore City residents who live and purchase within the grant-eligible Baltimore City area.

The $15,000 home purchase grant reduces the amount of money you will need up front to buy a home. The $20,000 home purchase & renovation grant reduces the amount of money you will need up front to buy and renovate a home. These grants do not have to be repaid!

Eligibility Criteria

To be eligible for the Buy Back the Block program, the following requirements must be met:

- You must currently live in the grant-eligible area and have lived there for at least 12 months before entering into a purchase agreement.

- You must purchase a home in the grant-eligible area.

- Your gross household income cannot exceed $140,760 or 120% AMI, whichever is greater.

- You must earn a homeownership counseling certificate from a City-approved counseling agency before making an offer on your home.

- You must work with a program-approved mortgage lender to obtain a fixed-rate mortgage.

- You can not currently own any real estate.

- You must be able to contribute at least $1,000 of your own funds to a home purchase.

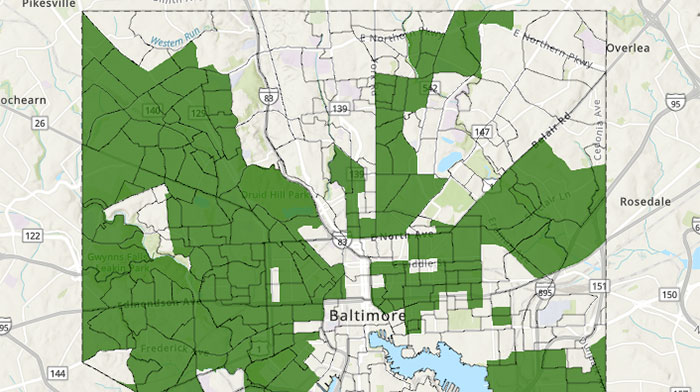

Verify Your Address

In order to be eligible for Buy Back the Block, you must currently live in and purchase a home in the Baltimore City grant-eligible area. You can use the map below to learn if your current or purchase address is in the grant-eligible area. Please note that the grant-eligible area is defined by the Qualified Census Tract (QCT) by the United States Department of Housing and Urban Development (HUD).

Here are the steps to get you started on checking your address:

- Click in the search field on the top right portion of the map below and start typing out your address. If you do not see a place to type in your address, click on the magnifying glass icon to open the field.

- Once you start typing your address, the dropdown will show auto-complete address options.

- Click on the address that you want. The map will zoom in on the area and show a pinpoint.

- If the color is white/beige, the address is NOT within the grant-eligible area. If it’s in a green area, the address is within the grant-eligible area.

Additional Resources

Program-approved mortgage lenders

You must work with one of the following mortgage lenders to receive Buy Back the Block funds.

For the $15,000 home purchase grant work with an approved Buy Back the Block lender to get pre-qualified for a fixed-rate mortgage. Your mortgage amount cannot exceed the current FHA mortgage limit for a single-family home.

For the $20,000 home purchase & renovation grant work with an approved Buy Back the Block lender to get pre-qualified for a fixed-rate purchase and renovation mortgage (such as an FHA 203(k), Fannie Mae HomeStyle, Freddie Mac CHOICERenovation, or other). Your mortgage amount cannot exceed the current FHA mortgage limit for a single-family home. Renovation guidelines vary by loan product. Speak with your lender for details.

Homeownership Counseling

In order to be eligible for the Buy Back the Block program, you must earn a homeownership counseling certificate from a City-approved counseling agency BEFORE making an offer on your home.

Counselors can also help you determine if you are ready for homeownership and review any credit issues that need to be addressed before applying for a mortgage. Some agencies offer additional services, such as post-purchase education, default and delinquency counseling, community outreach, and credit and budgeting classes. Homeownership certificates are valid for 12 months from the date of completion.

Your lender will have a checklist of required documents you will need to complete the application process. Make sure to work closely with them to get all the correct documents together.

Reach out to Live Baltimore staff for support by calling 410-637-3750 x 118.

Congratulations! Live Baltimore will still need to confirm your eligibility for the program. Please fill out the eligibility form as soon as possible. You can also reach out to baltimore@livebaltimore.com to ensure we’re aware of your timeline.

Note that Live Baltimore may not be able to process your application if your settlement date is less than 10 business days from your Eligibility Quiz submission date.

Grant funds are provided on a first-come, first-served basis until October 2026 or until grant funds run out—whichever comes first. Otherwise, there is no set deadline for applications.

Have more questions about Buy Back the Block?

We’re here to help. Send us an email or call 410-637-3750 for one-on-one assistance.

Funding for Buy Back the Block is made possible through an award from the Mayor and City Council of Baltimore, as well as a grant from the Mayor’s Office of Recovery Programs.

Explore More Ways to Afford Your Home

- Save your recommendations for later.

- Get access to our Financial Incentives Tool.

- Connect with a Live Baltimore staff member for a one-on-one consultation.

- Get a free I ♥ City Life bumper sticker.

- Save your recommendations for later.

- Get access to our Financial Incentives Tool.

- Connect with a Live Baltimore staff member for a one-on-one consultation.

- Get a free I ♥ City Life bumper sticker.